oregon statewide transit tax exemption

The transit tax. The statewide transit individual STI tax helps fund public transportation services within Oregon.

Columbia County Oregon Official Website Oregon State Senate Bill 48 Goes Into Effect On July 1 2022

Effective July 1 2018 employers must.

. The transit tax will include the following. Parts of HB 2017 related to the statewide transit tax. Unless there is a.

There are some organizations whose payroll is. Oregon tax filing and payment deadline from April 15 2020 to July 15 2020. Businesses - Statewide transit tax.

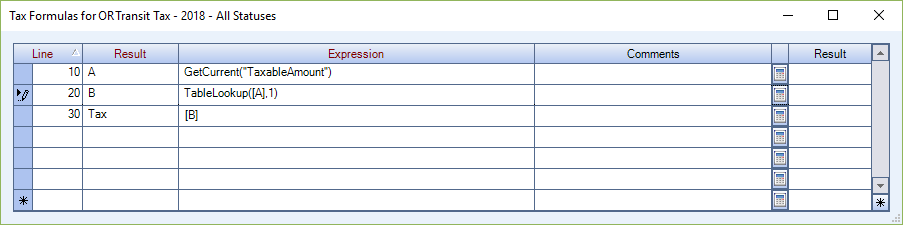

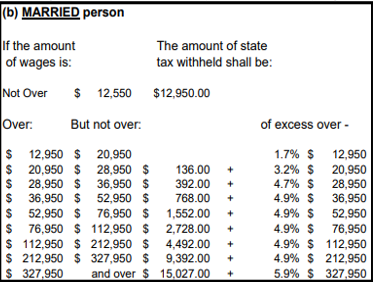

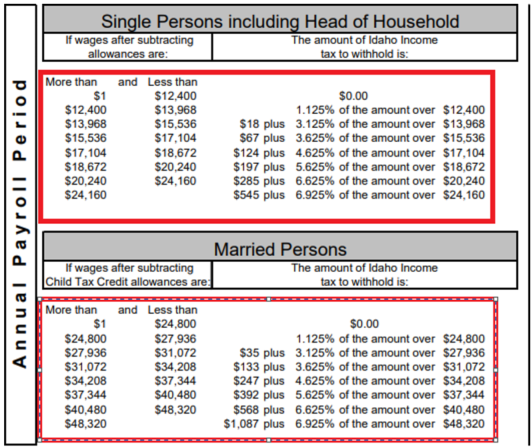

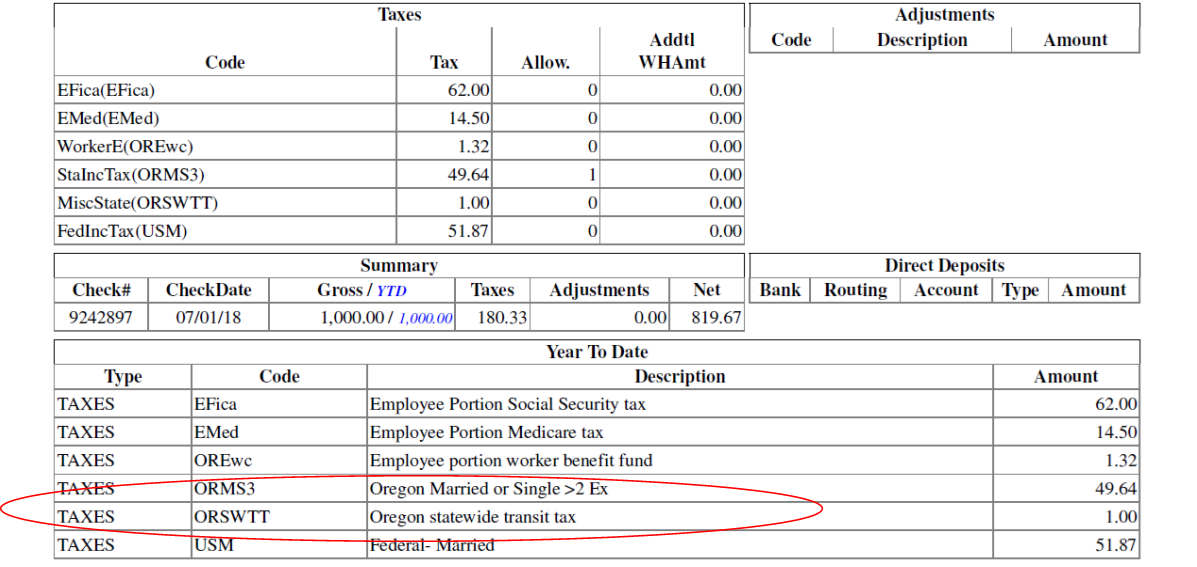

The statewide transit tax is calculated based on the employees wages as defined in ORS 316162. Click Accounts Affected choose Do not affect accounts or Affect liability and expense accounts. A Statewide transit tax is being implemented for the State of Oregon.

There is no maximum wage base. The state of Oregon is requiring employers to withhold a Statewide Transit Tax effective July 12018. This tax will be strictly enforced and employers could face penalties.

Oregons Statewide Transit Tax. An exempt organization filing an Oregon Form OR-20 is subject to either the computed excise tax based on UBTI after the specific deduction generally 1000 or the Oregon minimum tax. On July 1 2018 employers began withholding the tax one-tenth of 1 percent or 001 from.

State of Oregon. By Eduardo Peters August 15 2022 August 15 2022 All foreign insurance companies those formed under laws from other. Oregon Tax e-File Cigarette and Tobacco Uniformity Program.

The tax rate is 010 percent. Form OR-STT-1 Oregon Quarterly Statewide Transit Tax Withholding. A Statewide transit tax is being implemented for the State of Oregon.

Effective July 1 2018 Oregon workers must pay a Statewide Transit Tax to the state of Oregon at the rate of 001 01 on income that is subject to Oregon state. Who Is Exempt From Oregon Statewide Transit Tax. Domestic worker income is exempt from the statewide transit tax under ORS 3161622c.

Domestic worker income is exempt from the statewide transit tax under ORS 3161622c. Wages of Oregon residents. The tax rate is 010.

Transit payroll taxes are a tax on the employer that is paid by the employer based on the amount of payroll earned within a transit district. Statewide transit taxJuly 1 2018 On July 1 2018 employers must start withholding the statewide transit tax which is one-tenth of 1 percentfrom. Domestic employers are NOT required to file statewide transit tax returnsreports or withhold.

Businesses - Statewide transit tax. State of Oregon. The 2017 Oregon Legislature passed House Bill HB 2017 which included the new Statewide Transit Tax.

In Item Name column enter the OR - Statewide Transit Tax Emp payroll item. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. Employees who arent subject to regular income tax withholding due to high.

As a result interest and penalties with respect to the Oregon tax filings and payments extended by this Order will. About the tax The 2017 Oregon Legislature passed House Bill HB 2017 which included the new statewide transit tax. On July 1 2018 employers began withholding the tax one-tenth of 1 percent or 001 from.

The tax is one-tenth is calculated on wages earned by an employee who is an Oregon resident. Oregon employers must withhold 01 0001 from each employees gross. Form OR-STI-V Oregon Statewide Transit Individual Tax Payment Voucher Instructions.

What Is The Oregon Transit Tax Statewide Local

New Transit Tax Cardinal Services

Multi Unit Property Tax Exemption Eugene Or Website

Fill Free Fillable Forms For The State Of Oregon

Taxes On Unemployment Benefits A State By State Guide Kiplinger

412 Million In Federal Funding Shouldn T Focus On Freeways Transportation Commission Says Bikeportland

Navigating The New Oregon Transit Tax Delap

Sales Taxes In The United States Wikipedia

Oregon Payroll Tax And Registration Guide Peo Guide

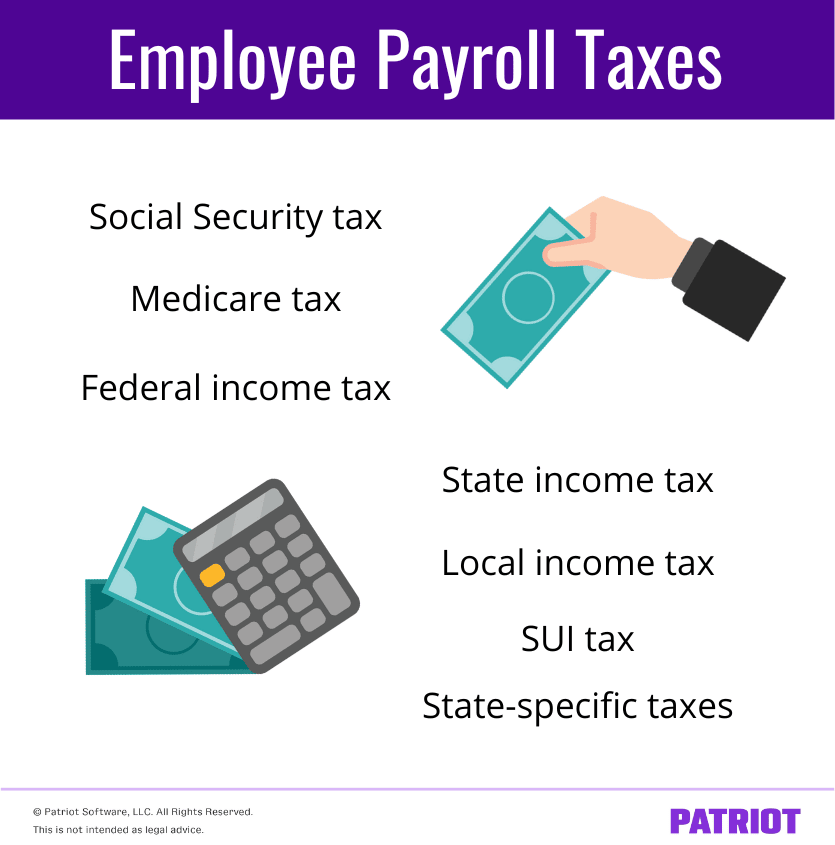

Payroll Taxes That Are The Employee S Responsibility

Printable Oregon Sales Tax Exemption Certificates

What Are State Payroll Taxes Payroll Taxes By State 2022

Oregon Metro Refers Multibillion Dollar Transportation Bond Measure To November Ballot Opb

Fill Free Fillable Forms For The State Of Oregon